Alpha Iban Holding Ltd is the parent of future companies, which will be established with

goal to provide investors with minimum of 30% per year increase capital invested in

equity funds, higher than with 99% of hedge funds in the world.

Alpha Iban Holding Ltd will

1) set up 9 subsidiaries:

- an asset management company in Switzerland,

- EIF as a protected cell company in Gibraltar with 7 long/short hedge funds (Mega Cap, Large Cap, Mid Cap, Small Cap, Micro Cap, Healthcare, Technology),

- 7 subsidiaries with marketing activities in New York, London, Luxembourg, Switzerland, UAE, Singapore and Hong Kong,

2) invest own money in 7 funds to show potential investors achieved performances.

1) set up 9 subsidiaries:

- an asset management company in Switzerland,

- EIF as a protected cell company in Gibraltar with 7 long/short hedge funds (Mega Cap, Large Cap, Mid Cap, Small Cap, Micro Cap, Healthcare, Technology),

- 7 subsidiaries with marketing activities in New York, London, Luxembourg, Switzerland, UAE, Singapore and Hong Kong,

2) invest own money in 7 funds to show potential investors achieved performances.

Contact: info(at)alphaiban.com

.

Why?

There are great investors, traders, managers and advisers in and around

the stock market. The best of them are well known, not just in financial circles. But

there are many more of those who are

far from any success.

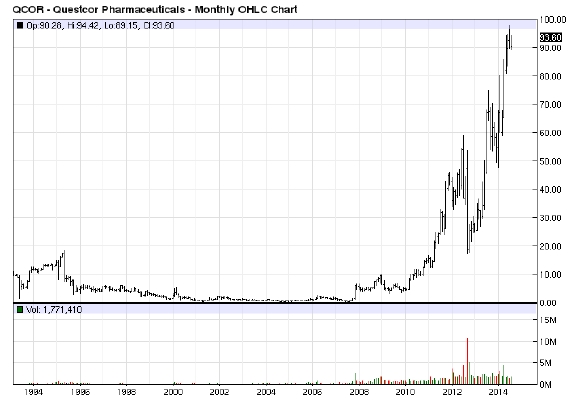

In summer 2014 Mallinckrodt acquired Questcor Pharmaceuticals for $ 5.8 billion (charts courtesy of barchart.com):

In summer 2014 also Whiting Petroleum acquired Kodiak Oil & Gas Corp. for

$ 6.2 billion.

These two acquisitions are great examples that there are too many incompetent

directors, managers, analysts and advisers because it was possible to acquire Questcor

for only $ 25 - 50 million in 2007 and Kodiak for only $ 100 – 200 million in 2009. And

nobody sized the opportunity even later, when their market capitalization was $ 500

million or a $ billion.

The consequences of these crazy acquisitions are very well seen nowadays.

The price of the Malinkrodt's stock at the time of Questcore's purchase was $ 80, and in

October 2020 it was only $ 0.14, while the price of the Whiting Petroleum stock at the

time of the Kodiak purchase - adjusted to the reverse split in 2020 - was $ 1,650, and in October 2020 only $ 14-17.

After the Questcor and Kodiak deals – when Pharmacyclics' market

capitalization was around $ 10 billion – it was easy to predict Pharmacyclics will be

one of the next insane acquisition targets, although in 2009 it was possible to buy the

company for only $ 100-200 million and in 2011 for only $ 400-800 million, but nobody

sized the opportunity. The news arrived in March 2015 – AbbVie will buy Pharmacyclics

for even $ 21 billion!

But that's just the tip of the iceberg. It can be added the $ 850 billion

giant Abu Dhabi Investment Authority's disastrous investment in City-group warrants

(2007), although ADIA has very qualified professionals. The founder of the Alpha

Iban Holding already on the day when the news published knew ADIA will lose entirely $

7.5 billion. After 12 months ADIA really lost $ 7.5 billion.

In 2008 NovaGold - 50% owner of one of the largest gold deposits in the

world - nearly went bankrupt and none of the big individual and institutional investors,

working with billions of dollars, concluded that the shares were almost free as the

price dropped from $ 20 to $ 0.45. The company was only saved thanks to a group of small

bankers who invested $ 70 million, so in two weeks the price rose to $ 2.95 and in two

years to $ 16.90!

Is it worth mentioning the Lehman Brothers catastrophe? How many formally high qualified

professionals had Lehman Brothers? Only the risk managers – 30.000!

Or that Norges Bank Investment Management, which manages a $ trillion

sovereign fund and where nobody can get a job without a master’s degree, has a poor

average 15 yearly performance only 3.7% after management fees, much less than S&P 500

index?

Or that Singapore's sovereign investment fund GIC, that manages $ 440

billion, has similar results: the annualized 20-year rate of return only 4.0%?

Or that Barron’s published a study showing the performance of big and

famous firms' "focus list" stock recommendations for 2014 - Bank of America, Merrill

Lynch, Goldman Sachs, RBC Capital Markets, Wedbush Securities and Stifel Financial

Management all underperformed the S&P 500, and Wedbush and Stifel actually posted

negative returns?!

Or that influential Goldman Sachs at the end of 2015 did not know what is

going on and what will happen in 2016 – Goldman made 6 top trade recommendations for

2016, but already on 9 February 2016 gave up and deleted 5 of them?!

Or that approximately 90% hedge and mutual funds permanently underperform benchmark S&P

500 index, and many funds have permanent negative returns. In 2019 S&P 500 had a stellar

gain 28.9%, but hedge funds returned only 6.96% on average.

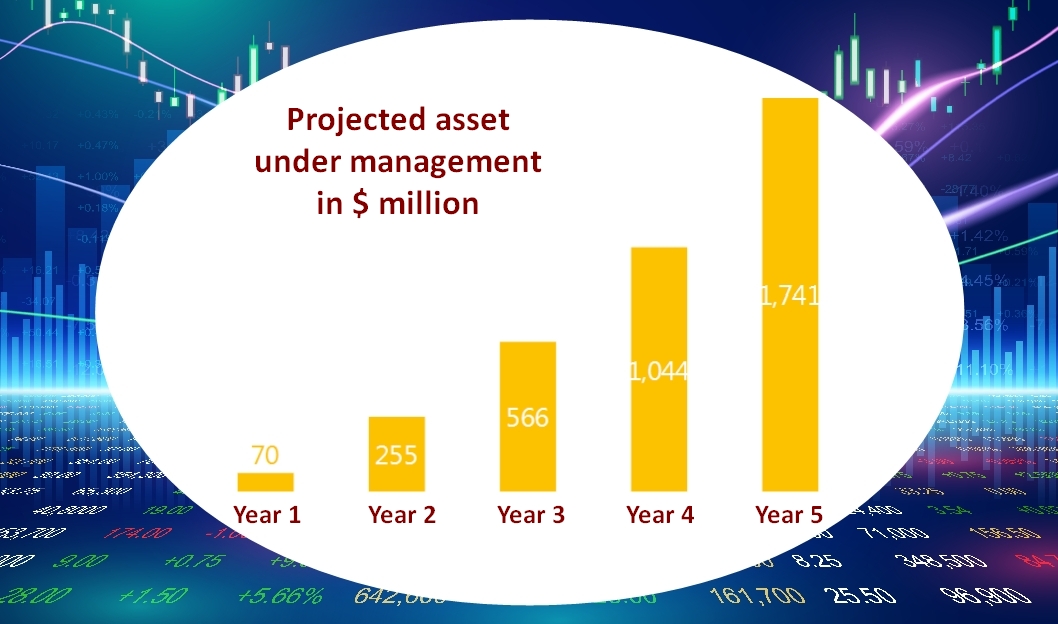

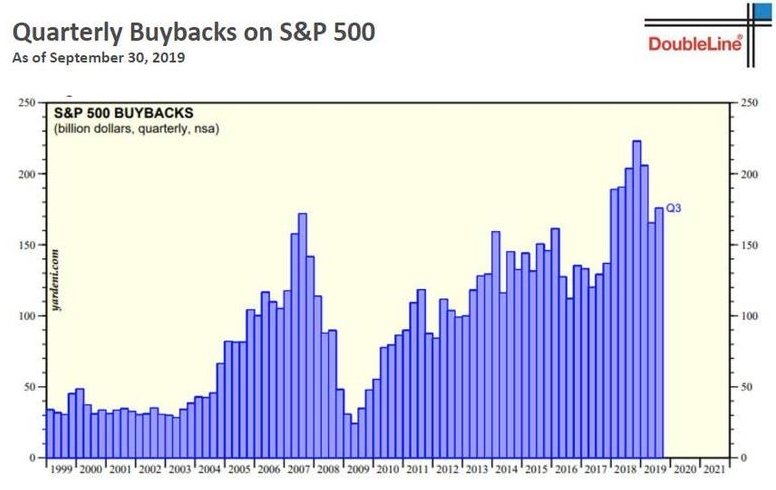

This chart about buyback programs in the USA is the best example of

incompetent and insane behavior. With shareholders' approval, top managers and directors

unnecessarily spent trillions of dollars buying the shares of their companies when the

prices are the highest instead when the shares are the cheapest. No one manages a home budget that way!

All in all, it is obviously that many (not all, of course!) top investment

directors, managers, analysts and advisors worldwide have tons formal qualifications a

la all sorts license series, CFA, CFP, CAIA, CPA certificates or MBA diplomas, but they

too often act foolishly because they have no elemental sense of judgment, let alone

broaden macroeconomic insight.

The logical consequence of many years of monitoring the US stock market

was the idea of creating a financial project that will give investors in equity funds an

above average return.

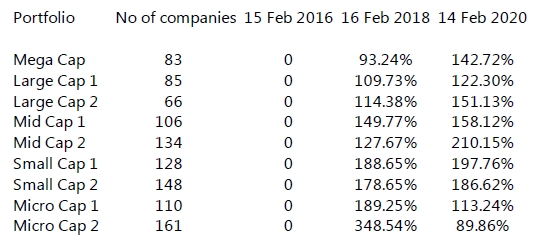

The preparations lasted almost 5 years. In the process, the idea was

double-checked. The first it was created 9 portfolios with more than 1,000 companies on

the US stock market, selected according to the specific criteria, and then they were

activated on paper in February 2016.

For two years only minimal changes were made within the portfolios,

replacing less than 10% of companies because some companies were headed in the wrong

direction. In February 2018 the portfolios' results were fantastic.

For the next two years, intentionally nothing was changed within the

portfolios and in February 2020 the results were expectedly worse. However, despite

giving up any changes within the portfolios, all portfolios after 4 years had a

respectable gain.

Although past successful performances are never a guarantee of future success, they are

an encouraging sign for desired future financial business.

Alpha Iban Holding's wholly owned subsidiaries will prove that the

outstanding success of an investment fund depends only on three factors: exceptional

management, extremely careful selection of companies and especially proper timing.

Alpha Iban Holding

Ltd,

all rights reserved. 2020